Passenger train and mass transit programs in the state may see an estimated $112 million increase annually if voters approve an amendment to the state constitution on Tuesday, May 5, 2014, raising the sales tax and restructuring how taxes are collected for transportation.

In a December lame-duck session, Michigan lawmakers approved plans for a statewide ballot proposal, called Proposal 1, and an 11-bill package that could yield $1.2 billion a year in new funding for roads and bridges as well as the estimated $112 million increase to the Comprehensive Transportation Fund (CTF) which funds programs such as passenger trains, transit programs, intercity bus and freight rail.

The $112 million figure forthe CTF was announced by Michigan Governor Rick Snyder at a Dec. 18 press conference.

Actual funding levels for each program in the CTF are subject to future legislative debate and appropriation bills. The revenue generated for the CTF also will depend on fuel prices and other factors.

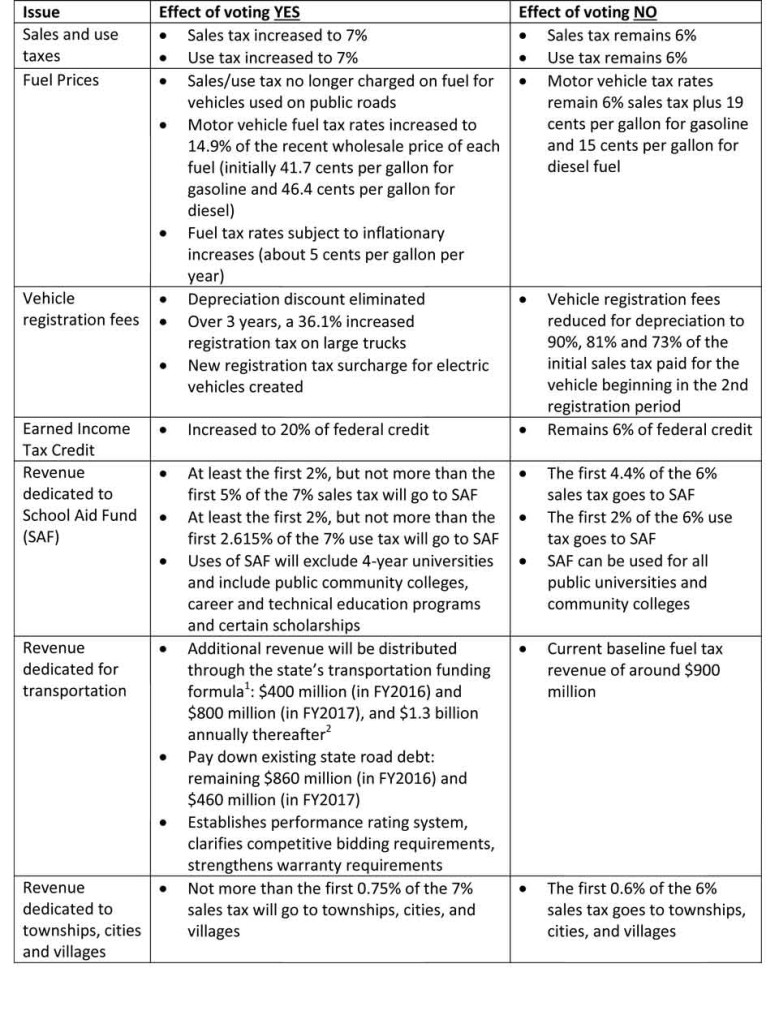

The proposal has been criticized as complicated and it has left many voters wondering what are the implications of a yes or no vote.

Gary Kuecken researched the issue and has broken it down here in terms of yes and no:

1The funding formula:

- 90% road repair and maintenance (for use only on road work)

- 39.1% Michigan Department of Transportation

- 39.1% county road commissions

- 21.8% cities and villages

- 10% Comprehensive Transportation Fund to benefit public transit programs

2Although it is very likely that this error will be corrected if the proposal is passed, the current wording of the current bill is as follows:

“the first $400,000,000.00 received and collected under this act” in FY2016 and “the first $800,000,000.00 received and collected under this act” in FY2017 would be distributed through the state funding formula

This amount applies to new revenue as well as existing funds such that around $1.7 billion (the $800 million intended earmark plus current baseline fuel tax revenue of around $900 million) would be earmarked for debt reduction in FY2016 resulting in a decrease in funding of $500 million from current levels.